A Hybrid Costing System Would Be Most Appropriate When:

A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. If a product uses more than one type of costing system select the appropriate combined item from the dropdown list on the right.

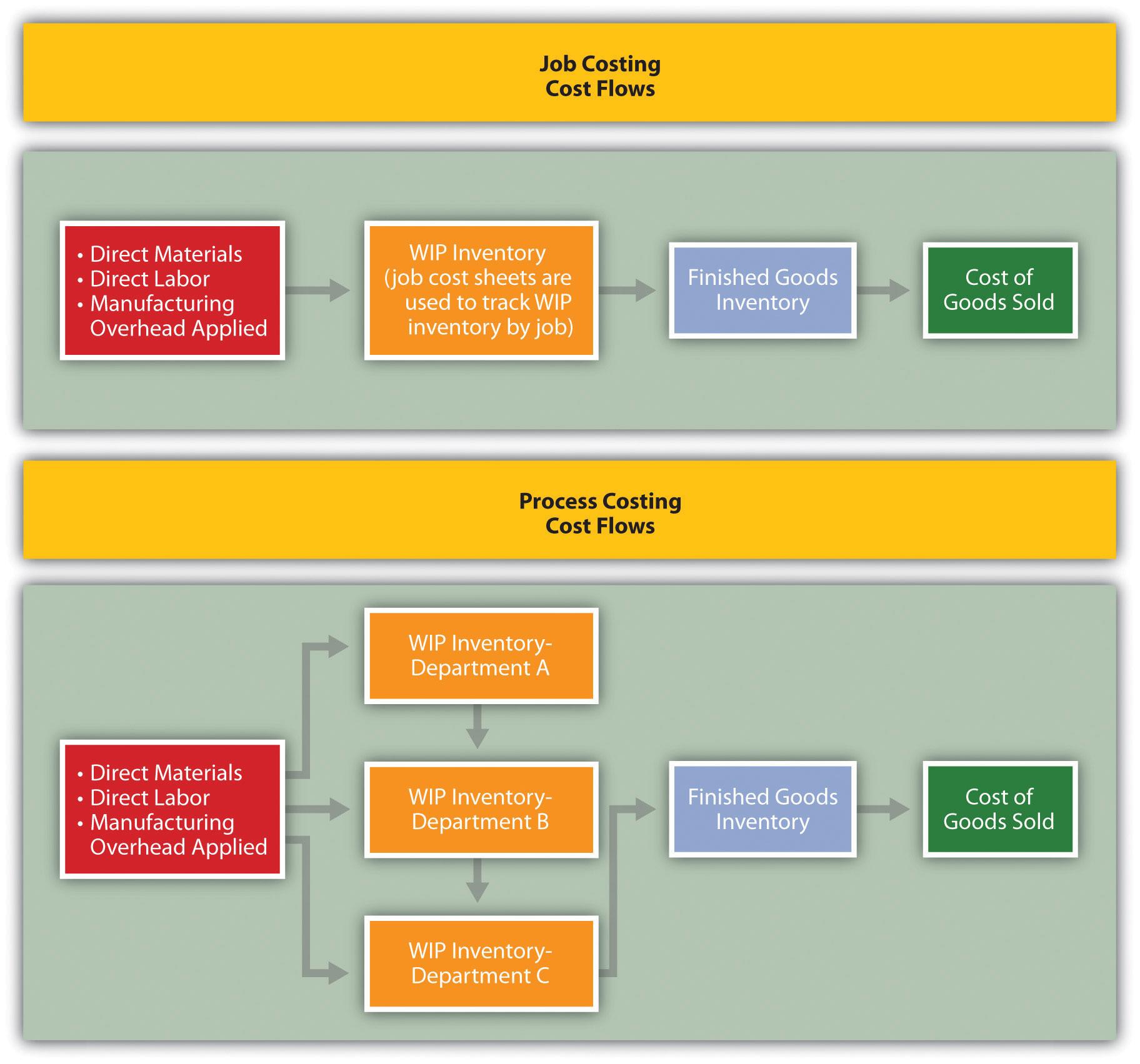

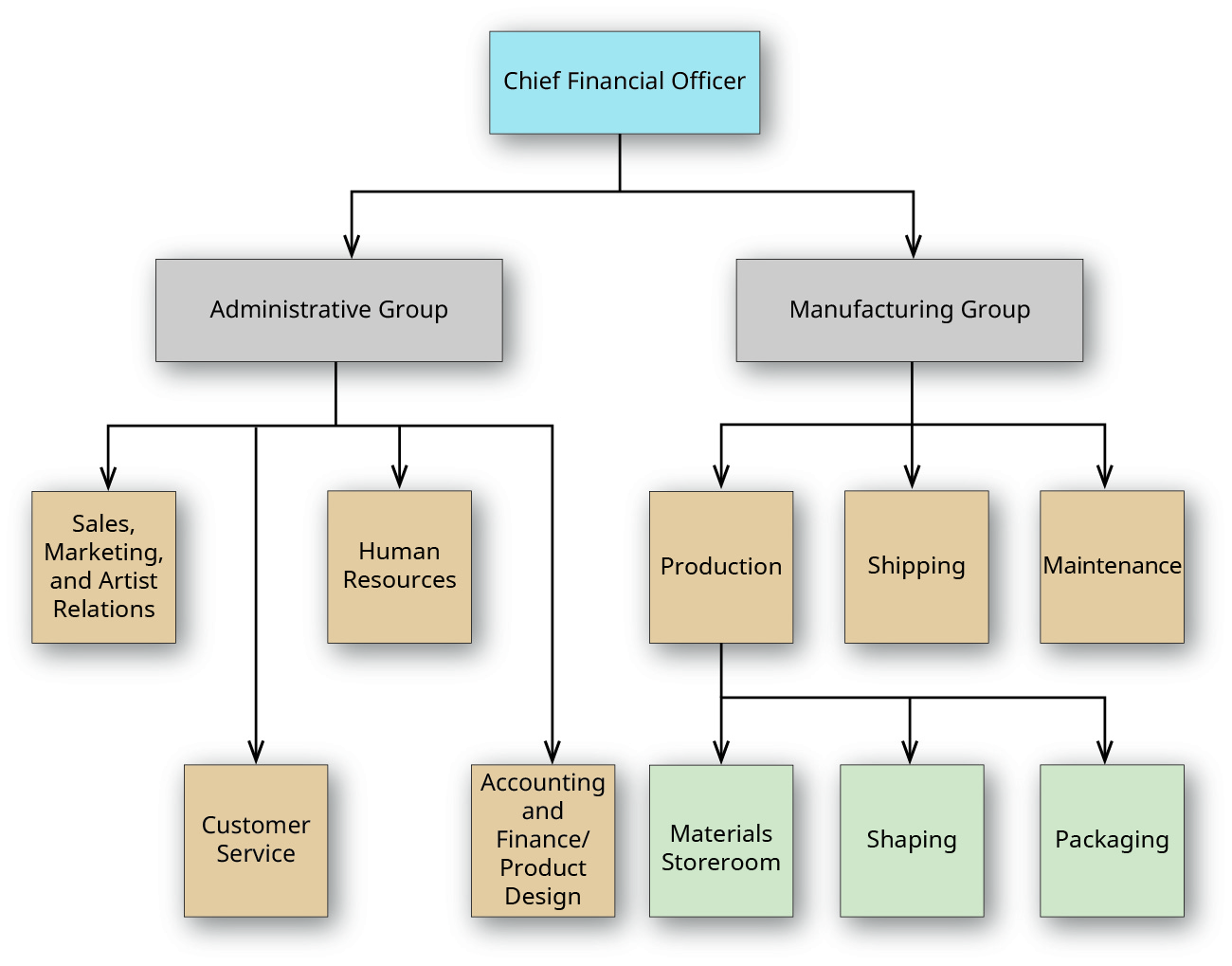

Comparison Of Job Costing With Process Costing

Large quantities of identical products are being produced.

. The primary costing systems are noted below. In process costing the cost object is masses of identical or similar units of a product or service. The volume of production is low and costs are high.

A manufacturer is able to standardize processes while at the same time attempting to cater to individual customer needs. A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. A business can accumulate information based on either one or adopt a hybrid approach that mixes and matches systems to best meet its needs.

Indicate which costing system job-order process or hybrid would be most appropriate for the type of product listed in the left-hand column. Matching products with appropriate costing systems Required Indicate which costing system job-order Matching products with appropriate costing systems Required Indicate which costing system job-order process or hybrid would be most appropriate for the type of product listed in the left-hand column. A hybrid costing system would be most appropriate when.

A hybrid costing system would be appropriate for a company that manufactures cake flour. Job costing accumulates costs by individual jobs. A hybrid costing system would be most appropriate when.

There are two main types of costing systems. The hybrid cost accounting system is based on a symbiosis of the principles. Large quantities of identical products are being produced.

But in practice the cost systems of many firms do not exactly fit in the category of either job crossing or process costing. A hybrid costing system would be most appropriate when. Asked Sep 13 2019 in Business by Hristo.

For example it is the cost accounting system used by oil refineries chemical producers etc. The volume of production is low and costs are high. There is no standardization of units of production.

Materials labor and overhead costs are compiled for an individual unit or job. Through hybrid costing overhead costs and labor costs must be allocated to goods produced. A hybrid costing system would be most appropriate when a manufacturer is able to standardize processes while at the same time attempting to meet individual customer need a production department is an organizational unit that has the responsibility.

What is a hybrid costing system. Find five companies in different industries on the Internet that you believe use process costing. Purchase A New Answer Custom new solution created by our subject matter experts.

Types of Costing Systems. A production department is an organizational unit that has the responsibility. Where as job costing systems would be used for the customized parts and custom assembly processes on each motorcycle.

Hybrid costing is used to separate costs and allocate costs to individual products or groups of products. Standard costing is compatible with both FIFO and weighted average methods of costing. The first item is shown as an example.

Because much of the production is the same for all products manufactured accountants use hybrid costing to distinguish these costs and determine individual product. Some important variants from these two basic systems are as under. See Page 1.

There is no standardization of units of production. The volume of production is low and costs are high. Hybrid Costing Systems.

There are situations when a firm uses a combination of features of both job-order costing and process costing in what is. A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. The volume of production is low and costs are high.

A hybrid costing system would be most appropriate when. Large quantities of identical products are being produced. How are costs accumulated in a job order costing system.

6-A hybrid costing system would be appropriate for a company that manufactures several varieties of jam. When is a hybrid costing system appropriate in a manufacturing setting. In this case cost accountants and managers would most likely use a hybrid costing system to track the manufacturing expenses of producing a motorcycle.

It is appropriate for products whose production is a process involving different departments and costs flow from one department to another. To obtain detailed cost information a hybrid cost accounting system is needed that combines process and job-order methods based on the accounting of normative standard and actual data by distributing costs for direct and indirect ones by allocating the variable and constant parts in indirect costs. Asked Jan 10 2019 in Business by Platini A A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs.

A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. Name these companies provide their Web addresses indicate what products they make and discuss why you believe they use process costing. Process costing systems would be used for the mass produced parts like the bike frames.

Large quantities of identical products are being produced. It works best in production environments where some of the manufacturing is in large batches. A hybrid costing system would be most appropriate when.

In a job-costing system the cost object is an individual unit batch or lot of a distinct product or service called a job. Under what circumstances is the use of such a system appropriate. A hybrid costing system would be most appropriate when.

A manufacturer is able to standardize processes while at the same time attempting to meet individual customer needs. The other option is a hybrid costing system where process costing is used part of the time and job costing is used the rest of the time. Multiple Choice All the products produced are unique.

We have seen that the cost systems based on the historical cost are broadly classified into two Job costing and Process costing. The job costing system is designed to accumulate costs for either individual units or for small production batches. Large quantities of identical products are being produced.

A hybrid costing system would be most appropriate when.

Compare And Contrast Job Order Costing And Process Costing Principles Of Accounting Volume 2 Managerial Accounting

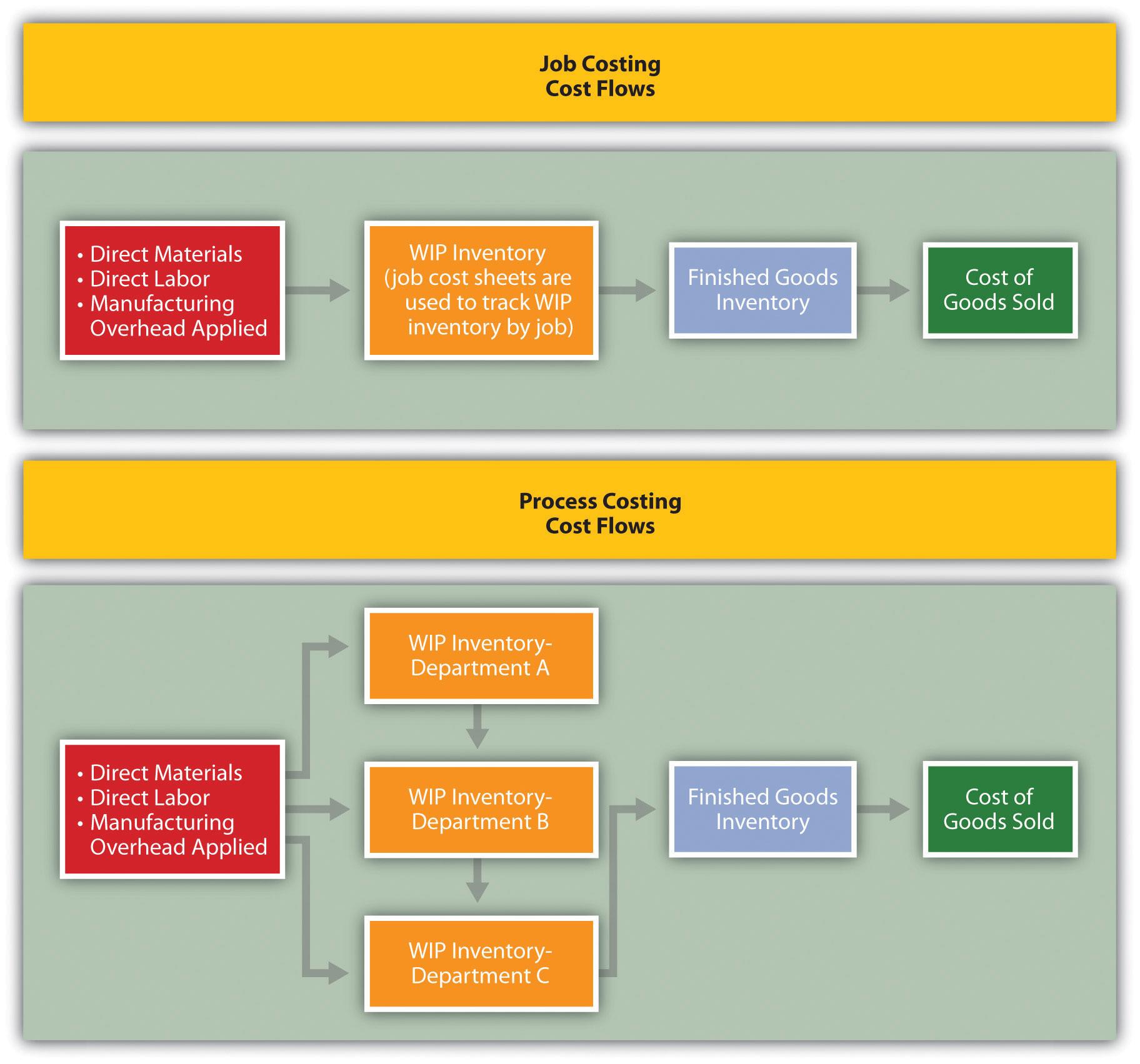

Bpc32603 Topic 4 Process Costing Ppt Download

Pdf Formation Of Hybrid Costing System Accounting Model At The Enterprise

No comments for "A Hybrid Costing System Would Be Most Appropriate When:"

Post a Comment